After missing last month’s newsletter due to being in the hospital with life threatening injuries, I thought I might just skip on writing my weird newsletter this year. But then I found some good things to share so I thought: let’s celebrate the end of January 2024 with at least one more.

After missing last month’s newsletter due to being in the hospital with life threatening injuries, I thought I might just skip on writing my weird newsletter this year. But then I found some good things to share so I thought: let’s celebrate the end of January 2024 with at least one more.

As far as January’s go, it’s been a relatively mild one, other than one week of polar vortex weather. Indeed, there’s been much mildness all around.

Pandemic-ally speaking, it’s also been a bit of a mildness in January in terms of COVID, as you can see from the Ontario wastewater signal:

Before Christmas 2023 there was a lot of talk of the new covid variant JN1 and how it could overwhelm hospitals like those in Ontario, but if it did, I suspect that is subsiding now. If anything, we are now seeing states like California and Oregon break with CDC guidelines and tell people you don’t have to isolate so much any more. As I said last year, 2023 should be a transition year for COVID. It will always be with us, like colds and flu, but we will make less and less of an issue of it by and large.

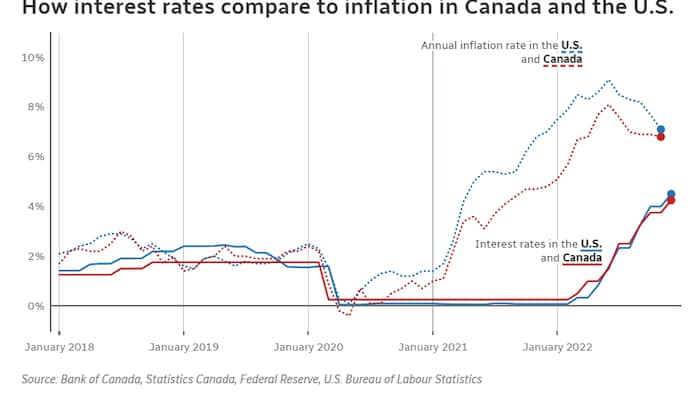

As for inflation, it’s also looking pretty mild, as you can see from this graph from Reuters:

A remarkable change from the peak of the pandemic. We have been living through some wild years. We could use some more mildness like this and a return to the way it was before the pandemic.

This is not to say everything is going back to pre-pandemic days. Take work. While there has been some people returning to the offices, I am not certain staff will ever fully return. For one thing, workers are more productive working for home. For another, cities and landlords are starting to accept it. New York is in the lead here I believe, with their Office Conversion Accelerator Team. There’s already a pack of offices with conversions underway. I expect more cities to follow NYC’s lead.

A new trend at work is the annual January layoffs. Tech companies like Google and Microsoft went through another round of year beginning job cuts, though it wasn’t limited to those two companies. And layoffs weren’t limited to tech, as anyone in the media can tell you. It was a brutal January for that industry. And then you had inexplicable moves like Conde Nast folding Pitchfork into GQ. Weird.

Relatedly, this piece on the history of the website Jezebel is the story of media from 2008 as told through this one property, imho.

As for that other form of media, social media, there’s really only two platforms that seem to matter anymore: TikTok and Substack. (Sorry, not sorry, Elon.) Here’s two Tiktok stories: one on the sleepy girl mocktail and one on cleantok and performative hygiene. Ugh. As for Substack, this and that report on Substack’s Nazi problem. Good lord. An overall sad state of affairs when it comes to social platforms.

I would like to say anything to do with web3, bitcoin, crypto, NFTs, etc is dead as a doorknob…but no. Like zombies, it’s coming back in the form of bitcoin ETFs from major asset managers like BlackRock and Fidelity. Caveat emptor, people.

I had some links to share regarding Taylor Swift and Barbie, but honestly you can easily search for that with your favorite search engine. Heck, you don’t have to search for it: go to any major website and they will have a story on them. Three or four stories, even.

I greatly enjoyed watching the Netflix series The Crown during the last few years. Here’s something ranking every episode of the series. A nice way for fans like myself to relive it.

One of my favorite films of all time is Moonstruck. The director of that film was Norman Jewison, who just recently died. The writer of the film, John Patrick Shanley, has a good remembrance of making that film with him, here. Highly recommended.

Last, here is an image of one of my favorite restaurants of all time, Prune, closed during the pandemic. I love the image of it below, and if you love it too you can buy it, here.

As always, thanks for reading this. See you in a month, I hope.